I first came across WYSIWYG many years ago in computer programming and it stands for:

What You See Is What You Get (Wee – zee – wig).

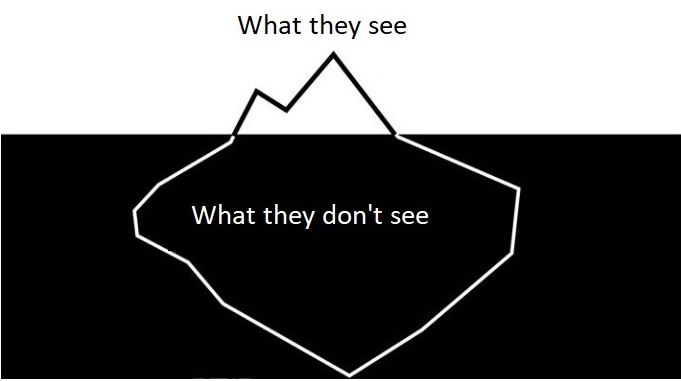

Recently I was doing some research on talking to children about money, and it struck me that this is never more true than in how children learn about the world. When young, the human brain learns from anything and everything that goes on around it. It then organises this information into rules about how the world works. Rules are important because there is so much information coming in that we need to organise it, or we would be overwhelmed. The brain uses these rules for creating a model of the world, so it can notice when things deviate from the model, and thus be alerted to potential danger. Running the brain this way also uses far less energy than having to analyse every input. This model of the world is constantly being updated as new information comes in, but over time, our models become more fixed. As we age, we tend to split information into things that agree with what we believe, i.e. what confirms the model, and things that don’t. Then, we usually ignore the things that don’t. So, first impressions are important, and an incomplete view of how things work will lead to an incomplete model of how things work.

When it comes to learning about money, children will build their models on what they see us do and the messages they get from the media and the broader social environment. I’m sure we’ve all heard stories of children who, when told that ‘I don’t have any money’, reply with ‘Why don’t you just get some more from the cashpoint?’ And, of course, that makes perfect sense to them. That’s where they see money coming from.

A few years ago somebody asked me ‘Why do we need to talk to our children about money?’, and, to be honest, I gave a reply that was utterly unconvincing. What is much clearer to me now is that if we don’t talk to our children about money, they will only associate money with what they see us do with it; and the most visible activity is spending. There are four other things you can do with money and they are: earn it, save it, give it and grow it. By the time they leave school, children will understand about earning and giving money. But if they don’t learn how to save it and grow it, they will never achieve financial freedom. And, while there is plenty of information about how to do both, if those concepts are not part of their model, they will not look for that information. Their model of the world is based on what’s visible to them. Saving and growing money are not visible activities, consumption is. Nearly a quarter of UK adults have no savings (2019 figures), so clearly this is a significant issue for our society. And, in order to change that, it’s really important that we show our children how to save money and grow money, so they can build those activities into their models of the world.

You can find our more by going to our Money and Kids page.