For planners and advisers, behavioural economics is a dead end

That was the bold claim made by Brian Portnoy at an adviser event called “Deeper Human Connection: Where Behavioural Science Meets Marketing”.

And I agree with him.

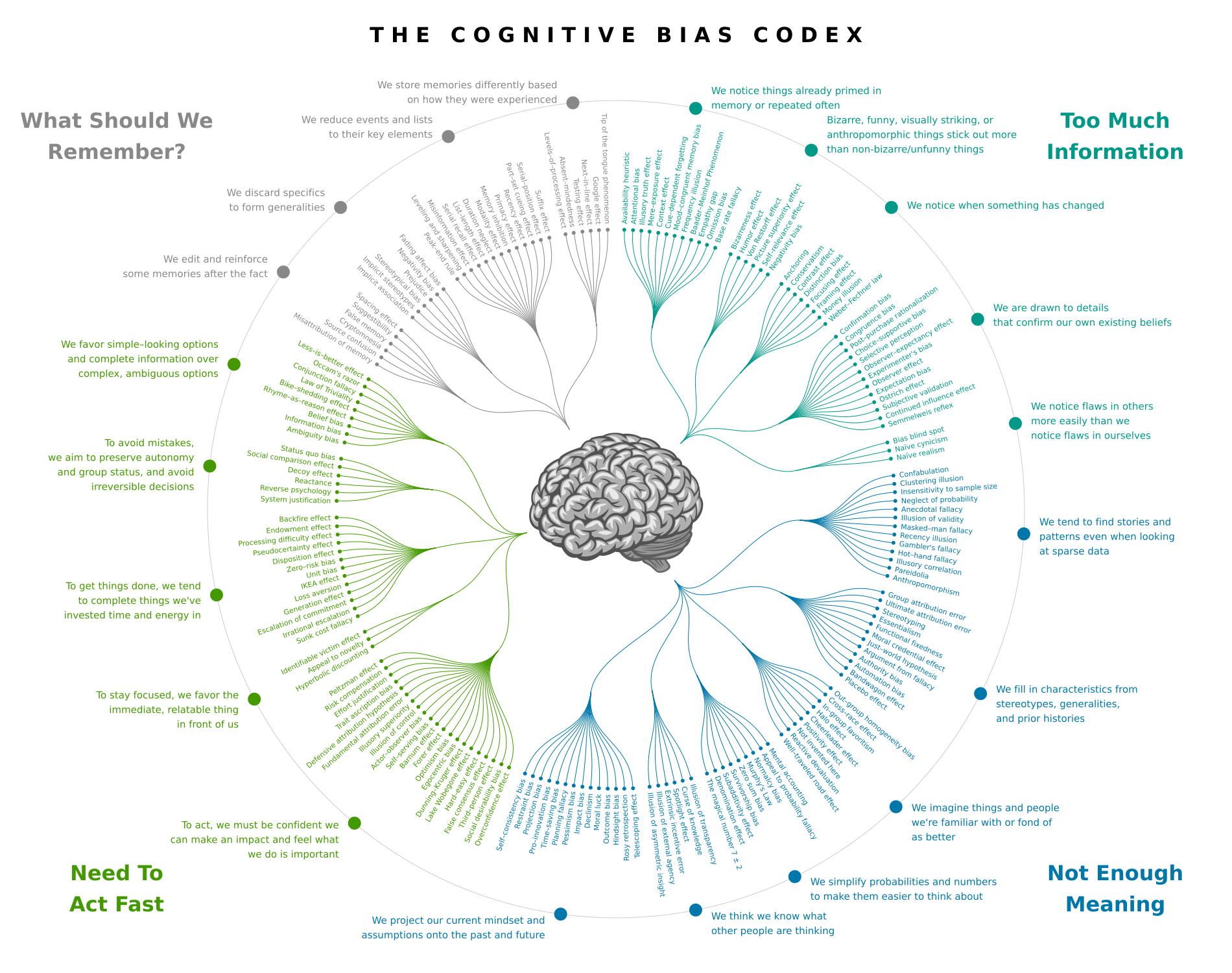

The graphic above from 2021 has 188 biases, and I’m sure social scientists have ‘found’ even more.

But all these so-called biases evolved to keep us alive. To call them biases is not helpful just because they interfere with what is perceived as an optimal investing approach. Our brains did not evolve for the purpose of long-term investing. In fact, they did not evolve to do long-term anything.

Daniel Kahneman – who is widely acknowledged as one of the pioneers of behavioural economics – was repeatedly asked whether all this research had helped him make better decisions. And his reply was always ‘Not at all’.

Another issue is what do you do with this information. How many clients respond positively to being told about their hindsight bias, or their recency bias?

But the fundamental problem is that behavioural economics tells you very little – if anything – about how the client in front of you makes their financial decisions.

That’s because behavioural economics is about cognitive biases. They are widespread – we all have them – and they are generally harmless tendencies in thinking that can lead to errors in judgement. They originate from shortcuts developed by the brain to streamline the processing of information.

What really matters at the client level is cognitive distortions.

These are the thought patterns that each person has that evolved from their past experiences and learned beliefs. Often exaggerated, extreme or outwardly irrational, they lead to self-sabotaging behaviours and self-limiting beliefs.

But it’s not always about extremes. Clients who can’t invest or talk about their spending are also probably suffering from cognitive distortions about what they can do, or what feels safe.

And because a clients money beliefs drive their behaviour, it’s these beliefs about what they can do, be or have with money, that will show up in your interactions with them.

Don’t waste your time with cognitive biases. Everybody has them.

Start thinking about cognitive distortions. That’s what’s driving the behaviour.

Learn what drives client money behaviour and take your client skills to a level you never thought possible.

Click the button below to see our learning options.

If you’d like to have a chat about how money coaching can help you, please click the button below.